Future Value of an Uneven Cash Flow Stream

R represents the interest rate and n represents the length of time. An annuity with payments that occur at the beginning of each period is known as a _____.

Future Value Of An Uneven Cashflow Youtube

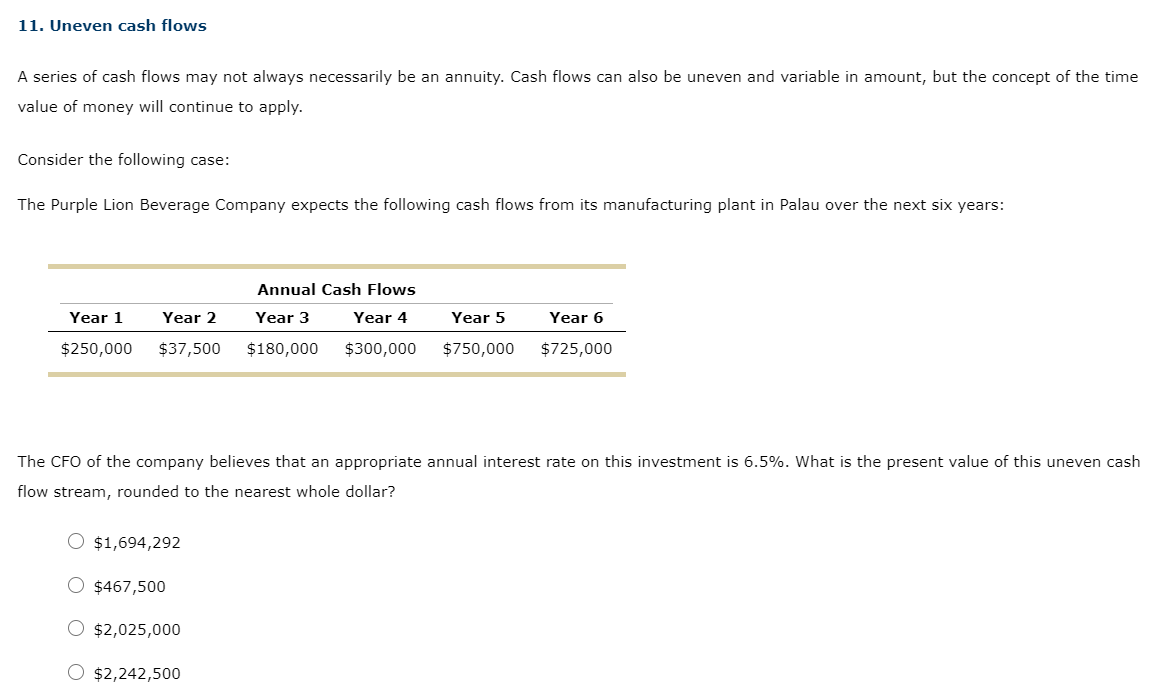

All amounts in the series of cash flows are not equal andor.

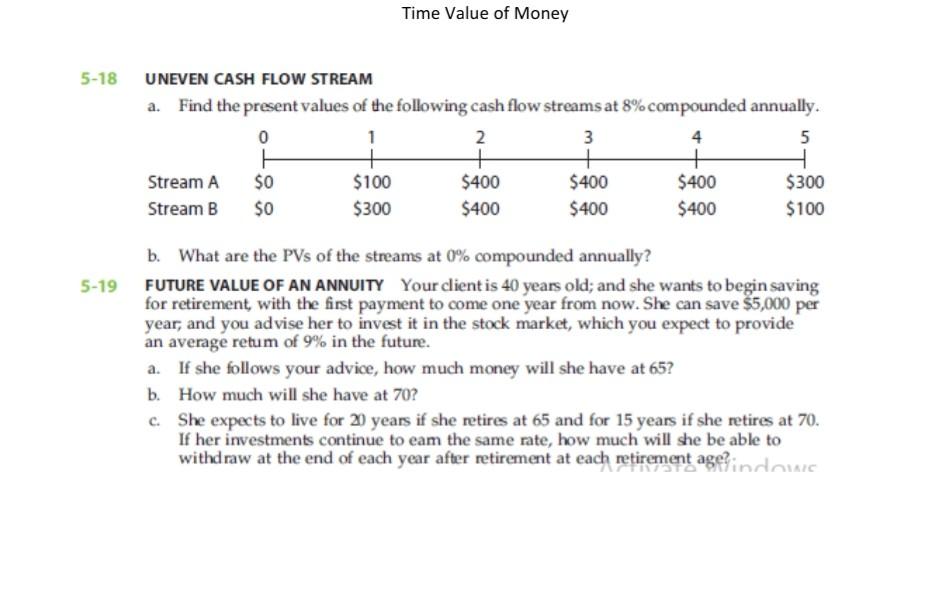

. In the formula CF represents cash flow i represents the interest rate m represents the number of compounding periods per year and n represents the number of years each cash flow earns interest. Investment End of Year A B. If this stream of spotty cash flows was produced by a given asset then.

In the picture above you can see that the future value at period 5 of the 100 cash flow in year 1 is 15735 C5. This is usually accomplished with the help of a spreadsheet. The future value of an uneven cash flow stream is also referred to as its _____.

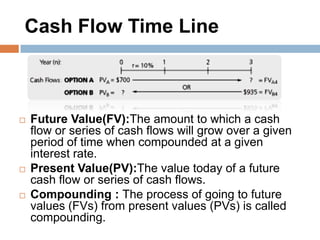

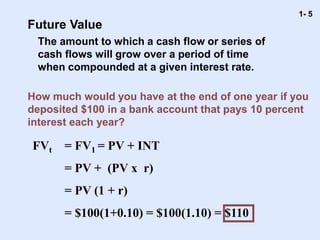

1 1 n r FV PMT r where PMT is the term used for the equal periodic cash flow r is the rate of interest and n is the number of periods involved. In this article we cover the definition of the future value of a mixed stream cash flow how to calculate it with example calculation as well as how we can generate a future value interest factors table. Compounding Formula FVPV1im FV Future Value PV Present Value i Interest rate annual m number of compounding periods per year n number of years.

Finance questions and answers. Herein what is irregular cash flow. The item that PMT is multiplied by is known as the Future Value Interest Factor of an Annuity FVIFA.

There is unequal time between any two cash flows. There is unequal time between any two cash flows. Present value of an uneven stream of payments You are given three investment alternatives to analyze.

The formula for calculating the future value of an annuity stream is as follows. Financial managers use financial formulas to find the present value of a series of future cash flows. For example a financial manager may calculate that the present value of a series of uneven cash flows is 1000 USD.

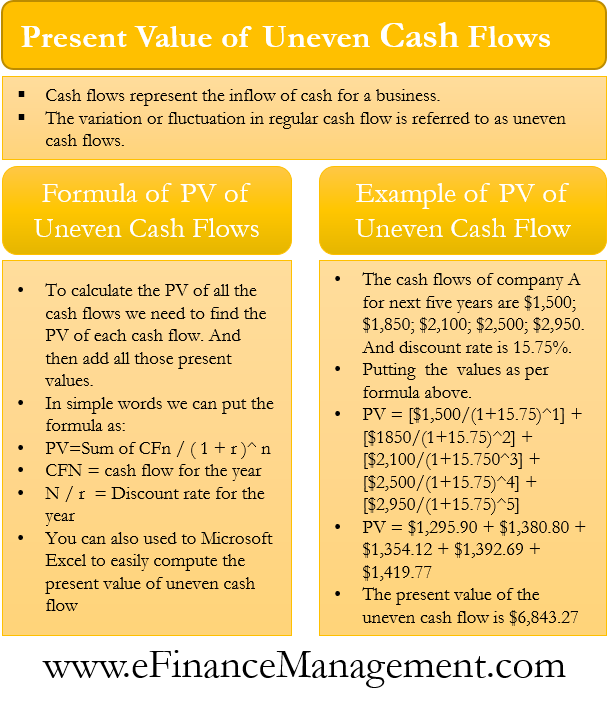

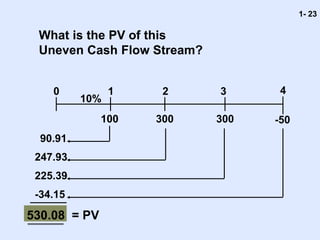

If our total number of periods is N the equation for the future value of the cash flow series is the summation of individual cash flows. Present Value When we have unequal cash flows we must first find the present value of each individual cash flow and then the sum of the respective present values. There is no single formula available to compute the present or future value of a series of uneven cash flows.

2500 10 P25000 Future Value of an Uneven Cash Flow Stream Uneven Cash Flows As from BABA 2 at University of St. However if your calculator doesnt have a net future value NFV key you can calculate the NFV as. When a cash flow stream is uneven the present value PV andor future value FV of the stream are calculated by finding the PV or FV of each individual cash flow and adding them up.

The first step is to compute the present value of each cash flow individually. This process helps them calculate the fair value of the investment in question. Future value of a mixed stream cash flow is simple to calculate.

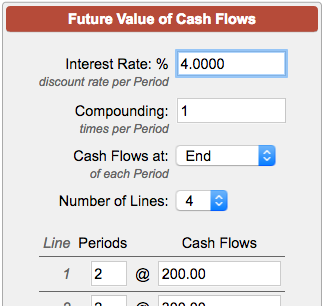

To get the present value of the cash flows press f PV youll see that the shifted version of PV is NPV. In this example the first formula is 1001 00522 x 2. Similarly the future value of an uneven cash flow stream is the sum of the FVs of the individual cash flows.

The terminal year is the final year of an analysis period. F V n 0 N C F n 1 i n N n For example i 4 004 compounding once per period for period n 5 CF 500 at the end of each period for a total number of periods of 7 Therefore. When a cash flow stream is uneven the present value PV andor future value FV of the stream are calculated by finding the PV or FV of each individual cash flow and adding them up.

Aterminal value bamortized value cconsolidated value dperiodic value ediscounted value. Problem 4-7 Present and Future Value of an Uneven Cash Flow Stream. Future Value of an Uneven Cashflow - Compounding Formula Cash Flow Watch Video is money you get a little at a time.

Substitute each uneven cash flow into the future value formula. That cash flow needs to be taken four periods forward moved from period 1 to 5 so the formula in C5 is. The present value is equal to the cash flow in year zero plus the sum from year one to the terminal year of CFn 1 rn where CFn is the cash flow in year n and r is the discount rate.

La Salle - Bacolod City. Joey is planning to invest his savings in a fixed income fund. Calculate the present value of an uneven cash flow stream.

The cash flows from these three investments are as follows. Which of the following is the correct expression for calculating the future value of an investment. All amounts in the series of cash flows are not equal andor.

Present value of an uneven stream of payments You are given three investment alternatives to analyze. An investment will pay 100 at the end of each of the next 3 years 400 at the end of Year 4 500 at the end of Year 5 and 800 at the end of Year 6. We find that the present value is 100017922.

A stream of cash flows is uneven when. It represents the future sum of returns that we will get at the future date. He manages to deposit 700 at the end of the first year 500 at the end of the second year 300 at the end of.

Example 31 Future Value of Uneven Cash Flows. Calculation of the present value of uneven cash flow is based on the flow of money and time period to be covered. Note that you can easily change the interest rate by simply entering a different rate into i and the solving for NPV again.

We start with the formula for PV of a future value FV single lump sum at time n and interest rate i P V F V 1 i n Substituting cash flow for time period n CFn for FV interest rate for the same period i n we calculate present value for the cash flow for that one period PVn P V n C F n 1 i n n. Many calculators have an NFV key that lets you obtain the FV. Contents Time Value of Money Annuities Perpetuities.

The future value of an uneven cash flow stream is also referred to as its _____. The future value of an uneven cash flow stream is also referred to as its _____.

Strayer Fin 534 Homework Set 2 2020 Solution Financial Analysis Homework Analysis

Future Value Of Uneven Cash Flows Hindi Youtube

Future Value Of A Mixed Stream Cash Flow Accounting Hub

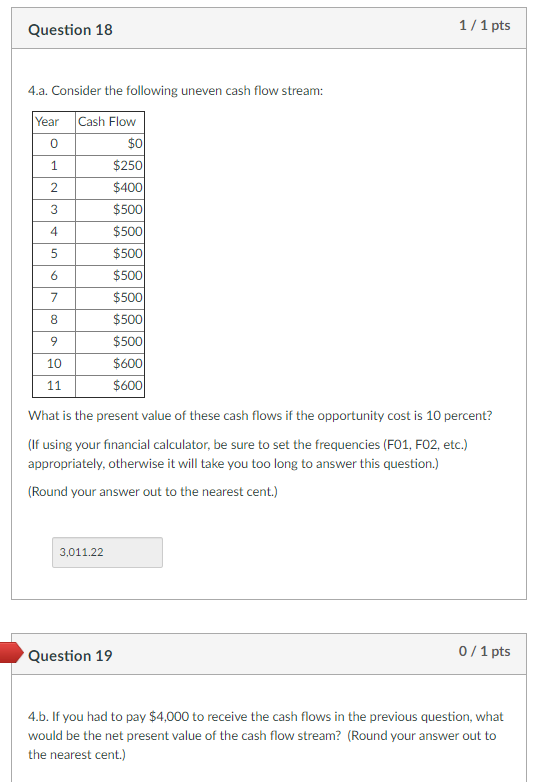

Solved Question 18 1 1 Pts 4 A Consider The Following Chegg Com

Present Value Of Uneven Cash Flows All You Need To Know

Future Value Of Cash Flows Function Microsoft Tech Community

Time Value Of Uneven Cash Flows Pv And Fv Formulas

Future Value Of Cash Flows Calculator

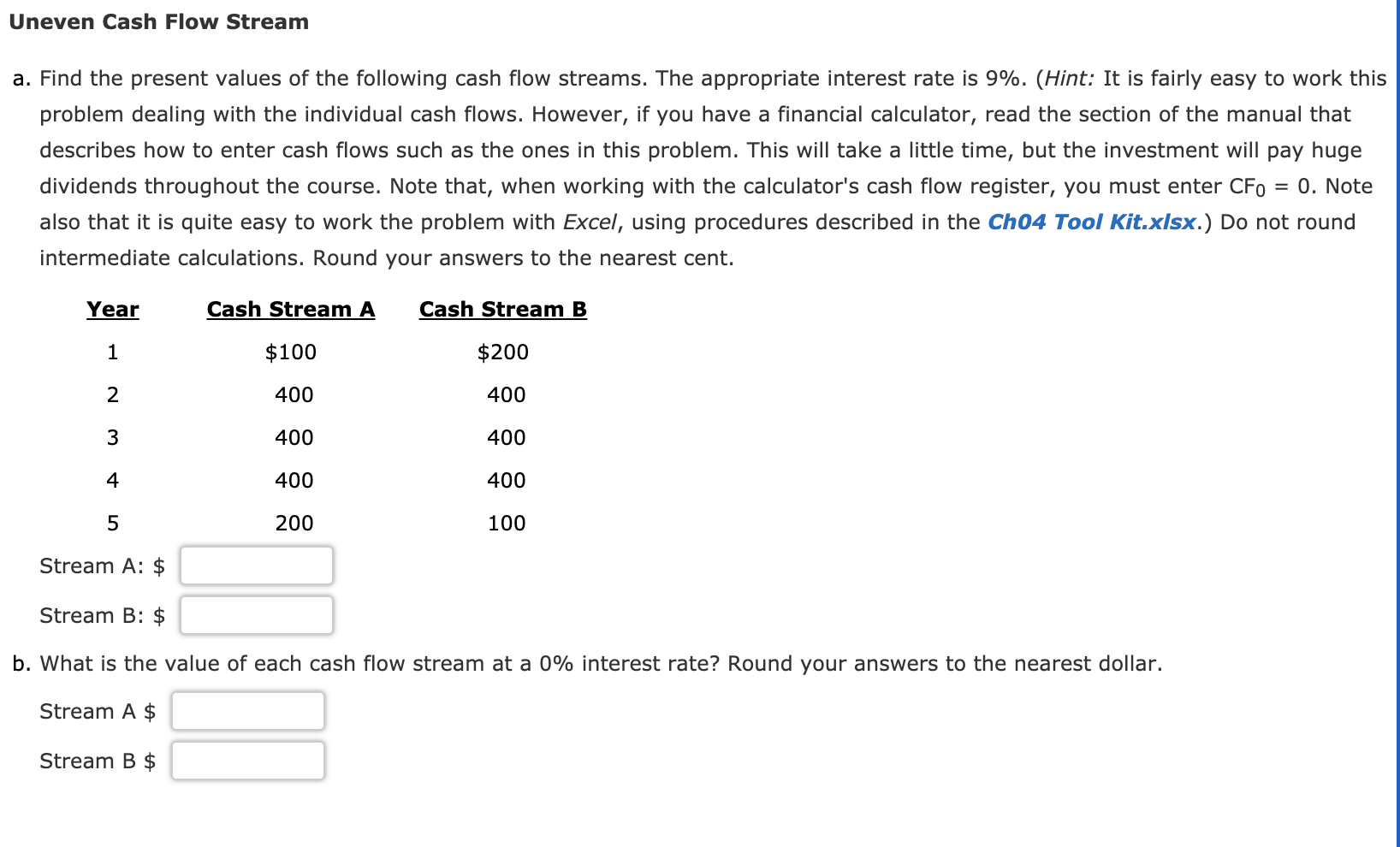

Solved Uneven Cash Flow Stream A Find The Present Values Of Chegg Com

Future Value Of Uneven Cash Flows Youtube

Future Value Of A Mixed Stream Cash Flow Accounting Hub

Solved Time Value Of Money 5 18 Uneven Cash Flow Stream A Chegg Com

Future Value Of A Mixed Stream Cash Flow Accounting Hub

Solved 11 Uneven Cash Flows A Series Of Cash Flows May Not Chegg Com

Future Value Of Cash Flows Function Microsoft Tech Community

Comments

Post a Comment